SECURE Act Legislation Includes Retirement Plan Changes

The end of year SECURE Act legislation along with the recent economic stimulus package includes significant changes to retirement plans. The following provides a summary of the impact.

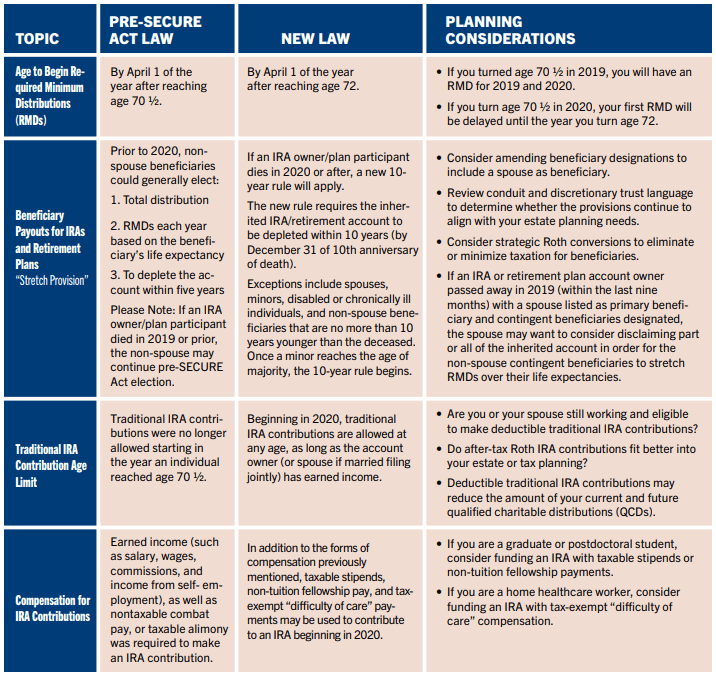

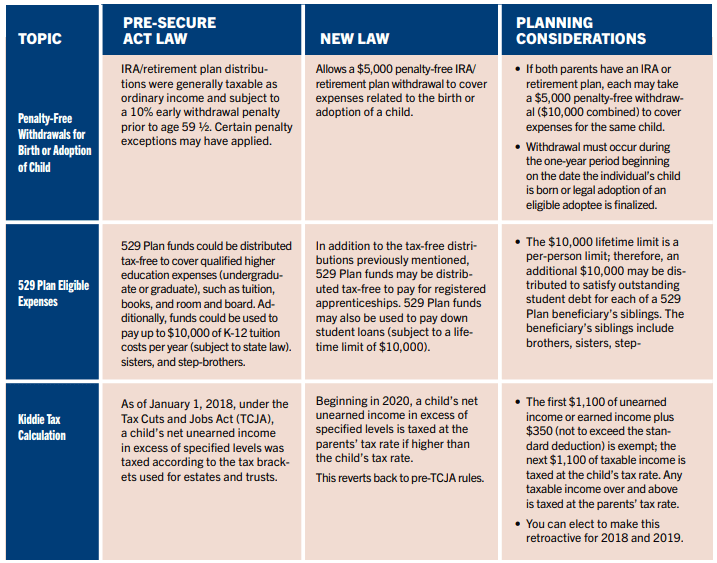

THE SECURE ACT

The Setting Every Community Up for Retirement Enhancements (SECURE) Act increases saving opportunities for Americans, with many of the provisions becoming effective January 1, 2020. The SECURE Act contains 29 separate provisions; below is a summary of some of the more substantial changes.

RETIREMENT ACCOUNT DISTRIBUTIONS RELIEF IN RESPONSE TO COVID-19

Congress has issued an economic stimulus package to help individuals and businesses endure financial hardship caused by the COVID-19 pandemic. As has proven essential in other financial emergencies, allowing retirement plan participants to have access to their retirement funds can help lessen the negative financial impact of being out of work for a continuous period of time.

Here are the distribution relief options available for retirement accounts:

- Retirement plan loan distribution limits doubled and repayment terms softened

- Special hardship distribution options introduced

- Required minimum distributions (RMDs) for 2020 postponed

Retirement Plan Loan Distributions

Congress has proposed changes to some of the existing rules for taking a loan distribution from a retirement plan along with adding some special features to help qualified individuals get back on their feet. These changes:

- Double the current plan loan limits to the lesser of $100,000 or 100% of the vested account balance

- Allow existing repayments and interest to be delayed during the months following the pandemic for up to 12 months

Hardship Distributions for IRAs and Retirement Plans

The stimulus package also provides the opportunity for qualified individuals to take a special hardship distribution of up to $100,000 from their IRA or retirement plan.

Who is a qualified individual?

- Anyone who contracts COVID-19

- Anyone who has a spouse or dependent who contracts COVID-19

- Anyone who experiences financial hardship from quarantine, being laid off, furloughed, a reduction of work hours due to the virus, or due to lack of child care due to the virus.

- Anyone who meets certain other factors as determined by the Secretary of the Treasury.

What are the special withdrawal provisions?

The new provisions allow individuals to:

- Withdraw up to $100,000 or 100% of the vested account balance

- Avoid the 10% early withdrawal penalty if below age 59½

- Take up to three years to repay the distribution to their retirement account

- Stretch income reporting over three years to lessen ordinary income tax implications

Considerations for Taking Advantage of One of the Distribution Relief Options

- Your ability to pay the money back to your retirement account within the allotted time

- Potential significant tax implications if the money is not recontributed to the plan

- Selling securities to take the withdrawal means potentially selling positions that are currently undervalued, thus locking in your losses

- Opportunity costs of getting out of the market now, especially if your asset value is down – by selling shares and receiving the cash, your money is no longer benefitting from compound and tax-deferred growth over time

Consider using other sources of capital before taking advantage of these special distribution options and consult your Stifel Financial Advisor before making this decision.

Required Minimum Distributions (RMDs)

Under current rules, required minimum distributions (RMDs) must be taken annually from IRAs and retirement plans generally for anyone age 72 and older. Concern has been raised about individuals taking RMDs from IRAs and retirement plans when there has not been enough time to recover account losses as a result of COVID-19; therefore, a temporary waiver for calendar year 2020 allows individuals to forgo the distribution. This waiver includes distributions that were required to be taken by April 1, 2020.

The IIAR and ARF reserve investment funds are currently managed by Stifel Financial Services under the investment policy established by their respective board of directors. Members of IIAR may use the services of Stifel for personal and business investments and take advantage of the reduced rate structure offered with IIAR membership. This information is for educational purposes only. Stifel does not provide legal or tax advice. You should consult with your legal and tax advisors regarding your particular situation. For additional wealth planning assistance, contact your Stifel representative: Jeff Howard or Jim Lenaghan at (251) 340-5044.